by Joan Buchman Miller | Apr 6, 2024 | 1099"s, deadlines, tax planning

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting...

by Joan Buchman Miller | Dec 18, 2023 | Accounting, deadlines, tax planning

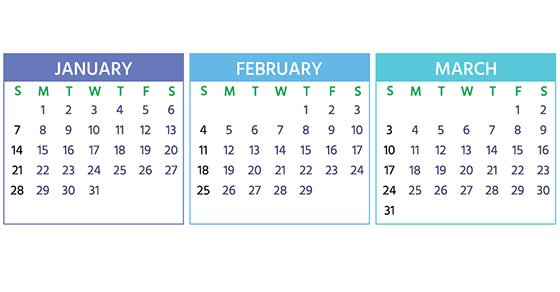

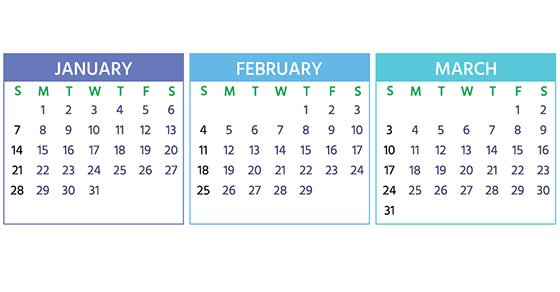

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing...

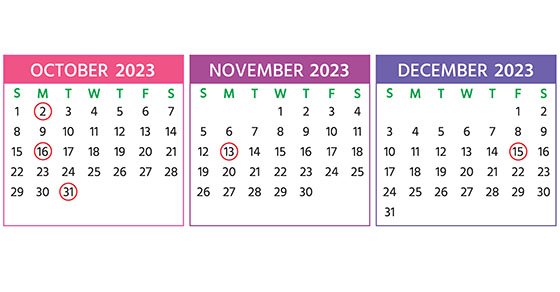

by Joan Buchman Miller | Sep 25, 2023 | Accounting, deadlines, tax planning

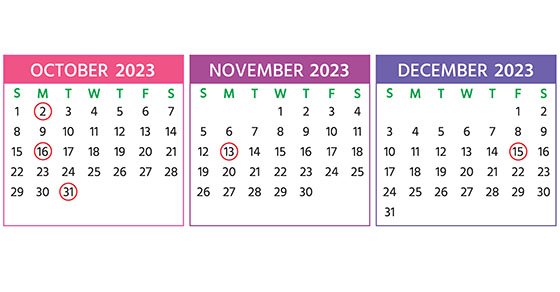

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all...

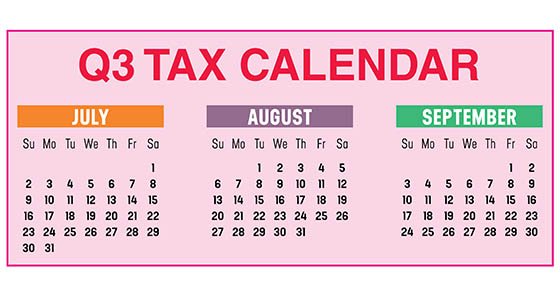

by Joan Buchman Miller | Jun 19, 2023 | Accounting, deadlines, tax planning

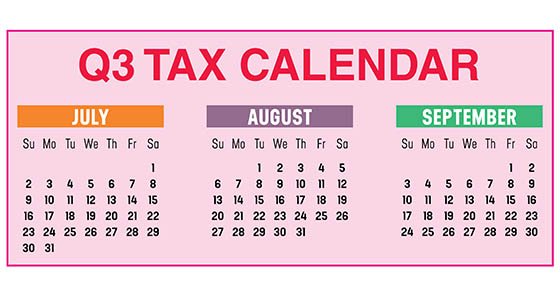

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all...

by Joan Buchman Miller | Mar 20, 2023 | Accounting, deadlines, tax planning

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting...

by Joan Buchman Miller | Dec 19, 2022 | Accounting, deadlines, tax planning

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing...