by Joan Buchman Miller | Nov 22, 2021 | Accounting, deadlines, employees, tax planning

The Employee Retention Credit (ERC) was a valuable tax credit that helped employers survive the COVID-19 pandemic. A new law has retroactively terminated it before it was scheduled to end. It now only applies through September 30, 2021 (rather than through...

by Joan Buchman Miller | Dec 4, 2017 | deadlines, W-2's

IRS has issued a reminder to employers and other businesses that 2017 W-2 and 1099-MISC forms that report non-employee compensation must be filed by Jan. 31, 2018. In general, information returns are required to be filed for compensation paid by persons engaged in a...

by Joan Buchman Miller | Nov 20, 2017 | deadlines

Mark your calendars for December 15, 2017! The clock is quickly ticking towards the deadline to sign up for health insurance for 2018. The 2018 open enrollment period is shorter than in previous years. The window opened on November 1, 2017 and the enrollment period...

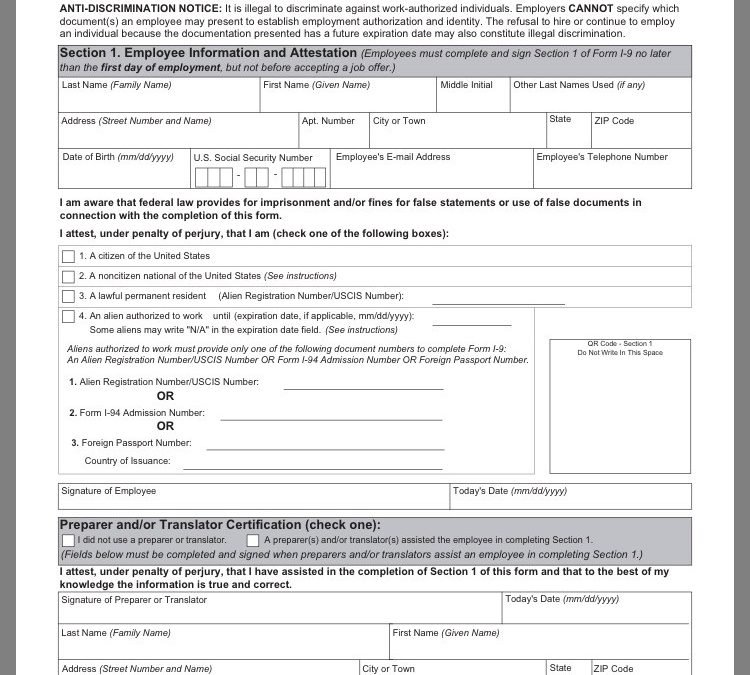

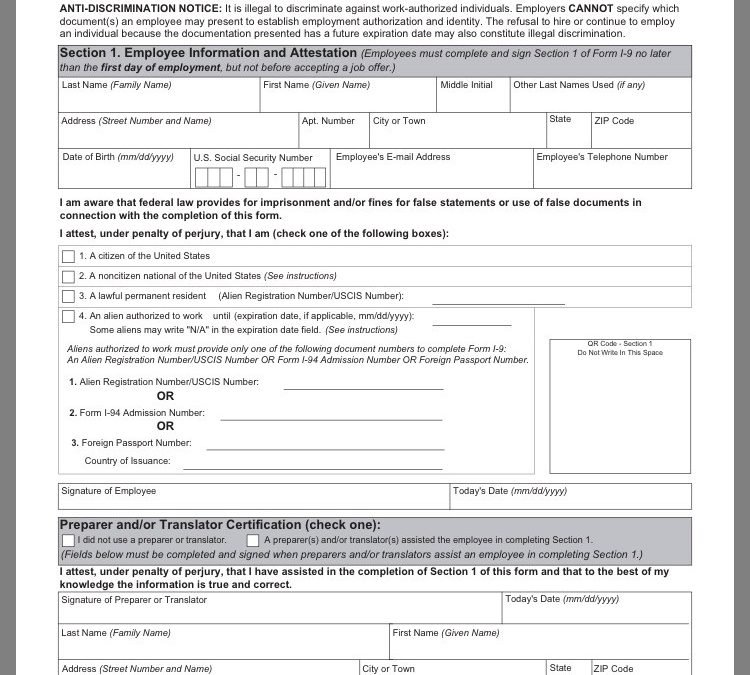

by Joan Buchman Miller | Sep 9, 2017 | deadlines, employees

The U.S. Citizenship and Immigration Service (USCIS) published a revised I-9 form in July 2017. On September 18, 2017 employers must use the revised form with a revision date of 07/17/17 N. The new form was modified with the intention to make it easier to navigate and...

by Joan Buchman Miller | Jan 9, 2017 | 1099"s, deadlines, W-2's

Reminder: Jan. 31 is due date for W-2 and 1099-MISC forms Unlike in prior years, 2016 W-2 forms (Wage and Tax Statement) that report employee compensation and 2016 1099-MISC forms (Miscellaneous Income) that report non-employee compensation must be filed by January...